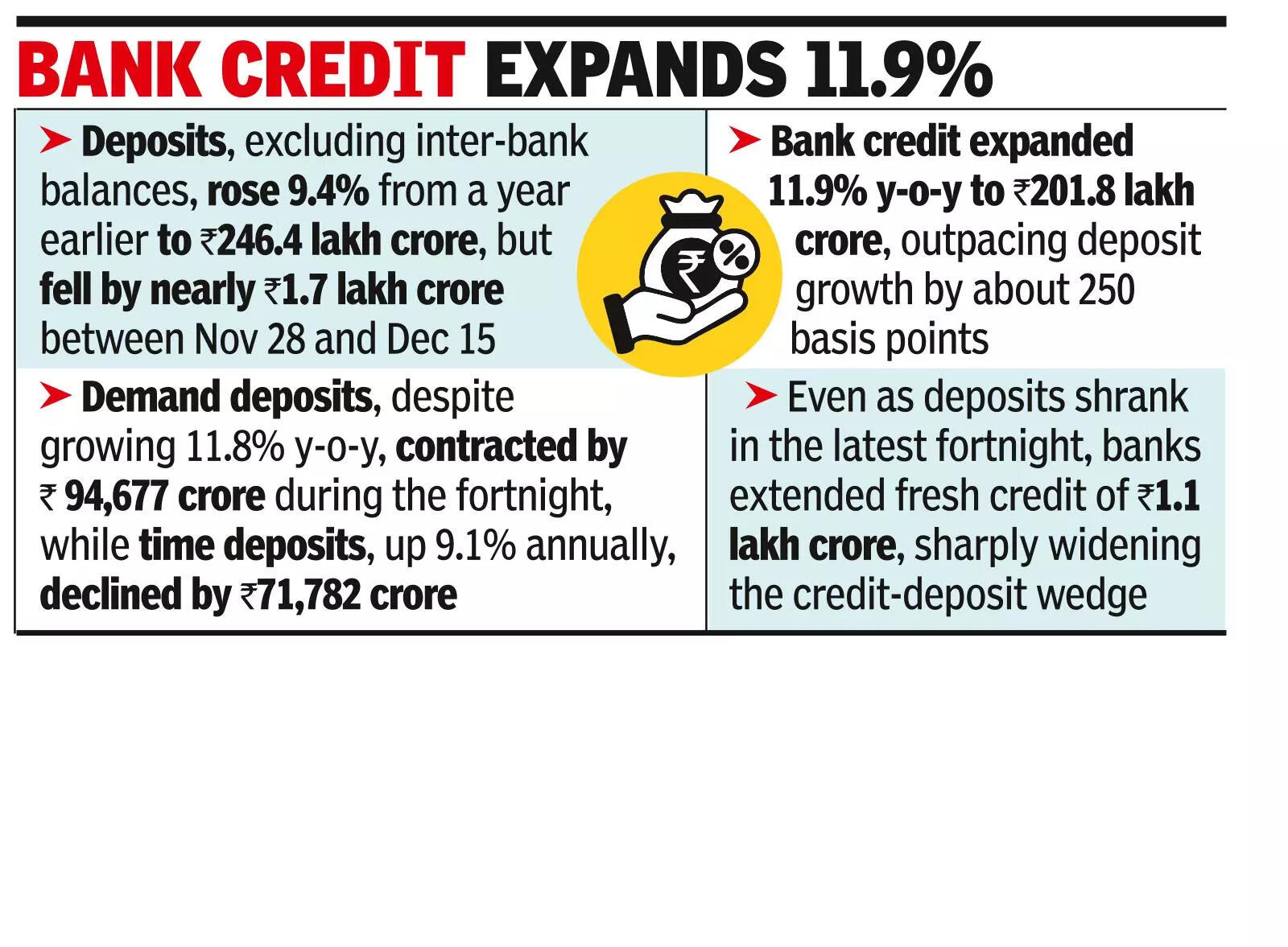

MUMBAI: Deposit outflows during the first half of Dec, which was largely attributed to tax payments, widened the gap between credit offtake and deposit accretion at scheduled banks, highlighting a growing structural imbalance in the system. According to RBI data, on a year-on-year basis, deposit growth continued to lag credit expansion during the fortnight ended Dec 15 and turned negative over the previous fortnight. Deposits, excluding inter-bank balances, rose 9.4% from a year earlier to Rs 246.4 lakh crore, but fell by nearly Rs 1.7 lakh crore between Nov 28 and Dec 15. Demand deposits, despite growing 11.8% y-o-y, contracted by Rs 94,677 crore during the fortnight, while time deposits, up 9.1% annually, declined by Rs 71,782 crore.

Bank credit expands 11.9%

Credit growth, by contrast, remained strong. Bank credit expanded 11.9% y-o-y to Rs 201.8 lakh crore, outpacing deposit growth by about 250 basis points. Even as deposits shrank in the latest fortnight, banks extended fresh credit of Rs 1.1 lakh crore, sharply widening the credit-deposit wedge. To bridge the mismatch, banks appear to have leaned on alternative sources of liquidity. Borrowings from RBI jumped from Rs 2,144 crore to Rs 26,568 crore over the fortnight, while investments declined. Banks’ investment portfolios grew only 5.1% y-o-y and fell by Rs 16,713 crore in the latest fortnight, suggesting liquidation of govt and other approved securities to fund credit demand in the absence of fresh deposits. Bankers said bank credit running ahead of deposit growth is usually self-correcting, as money lent out ultimately results in deposit growth. A new bank loan normally creates a matching deposit, thereby lifting aggregate deposits as net lending increases. Loan repayments do the reverse, shrinking deposits as bank assets and liabilities contract. However, if banks originate loans and then quickly securitise or sell them, using the proceeds to make more loans, reported credit can rise while the associated deposits sit with investors or move off balance sheets, limiting net deposit growth at the system level. Similarly, loans funded through central bank refinancing lines or wholesale market borrowing expand credit without a commensurate rise in customer deposits, as liability growth accrues to central bank or wholesale funding rather than retail deposits.